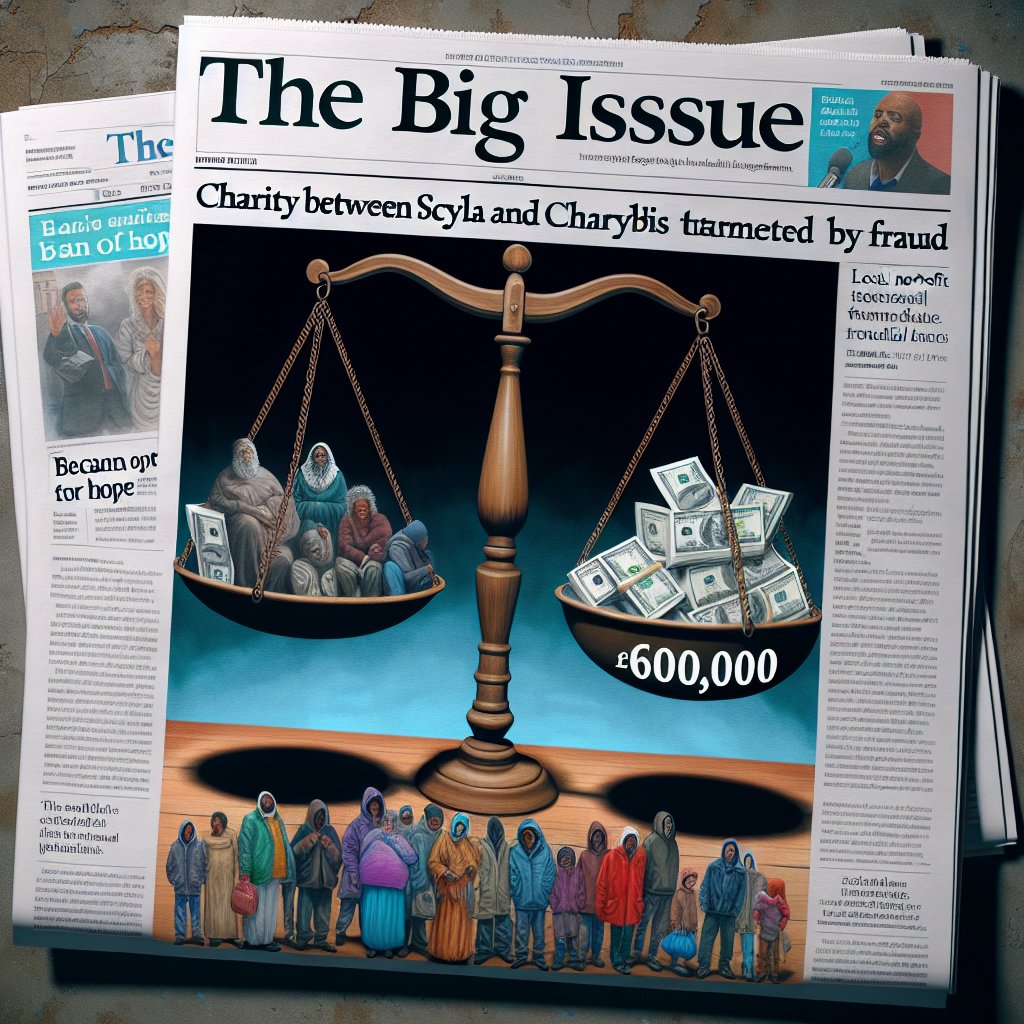

Image: AI generated for illustration purposes

The Big Issue’s Crisis: A Call for FNB to Address Fraudulent Misappropriation of Funds

In a disturbing development for South African civil society, The Big Issue, an esteemed non-profit publication sold by homeless individuals as a means of support, is grappling with financial turmoil following fraudulent activities linked to a First National Bank (FNB) account.

The Big Issue South Africa, operating as a bridge between the marginalized and the mainstream, provides homeless and vulnerably housed street vendors with legitimate income. For many, this has been a beacon of hope and an opportunity to reintegrate into society. However, the integrity of this initiative is currently undermined by fraudulent actions leading to a precipitous scenario that could spell its end.

Trouble mounted for The Big Issue when an email, ostensibly from its printer and containing falsified bank details, prompted the non-profit to erroneously redirect R600,000 into a scammers' FNB account. This occurred over the span of three months, with the beleaguered charity discovering the deception only after substantial losses had been incurred.

This case puts a spotlight on the banking industry's due diligence protocols. The Financial Intelligence Centre Act (FICA), aimed at combatting illicit financial activities, obliges banks to rigorously vet account holders to prevent activities such as money laundering and terrorist financing. Yet in this instance, the stringent measures have seemingly fallen short or been exploited by criminal elements, implicating the involved financial institution's ability to safeguard against and address fraudulent transactions effectively.

FNB's response has been unconvincing in the eyes of the concerned public and directly affected parties. The promise of assistance to law enforcement does little to alleviate the immediate crisis faced by The Big Issue, nor does it assuage doubts regarding the practical effectiveness of FICA, especially when malefactors appear to bypass these measures with disquieting ease.

What this situation demands is a robust reaction from FNB, one that goes beyond administrative complacency. It's not just a matter of recovering lost funds; it's about shouldering corporate responsibility and making reparations that resonate with the core values of community support. Given the scale of The Big Issue's loss relative to FNB's financial stature, the bank is positioned to render crucial assistance, either by aiding in the swift retrieval of the stolen funds or by an act of goodwill — donating the equivalent amount to rescue the imperiled publication.

Such a gesture would not only potentially prevent the collapse of an institution that has stood as a pillar for the disadvantaged but also send a meaningful message regarding the role of banking institutions in safeguarding citizens and civic organizations against fraud. Given the gravity of the situation, it is imperative that actors within the banking sector acknowledge and act upon their part in this societal ecosystem. With the ball in FNB's court, the time to make a difference is now before The Big Issue becomes another regrettable tale of what once was.