Image created by AI

Gauteng Siblings Face Justice for Alleged R150 Million Bank Fraud

In a dramatic unfolding of events, two siblings stand accused of an elaborate fraud scheme, amounting to a staggering R150 million, which has landed them in the dock at the Palm Ridge Specialized Commercial Crime Court in Gauteng. The duo, Nishani Singh, a 51-year-old woman, and her younger brother, Rushil Singh, a 40-year-old man, are currently in custody, facing serious allegations of fraud, forgery, and uttering.

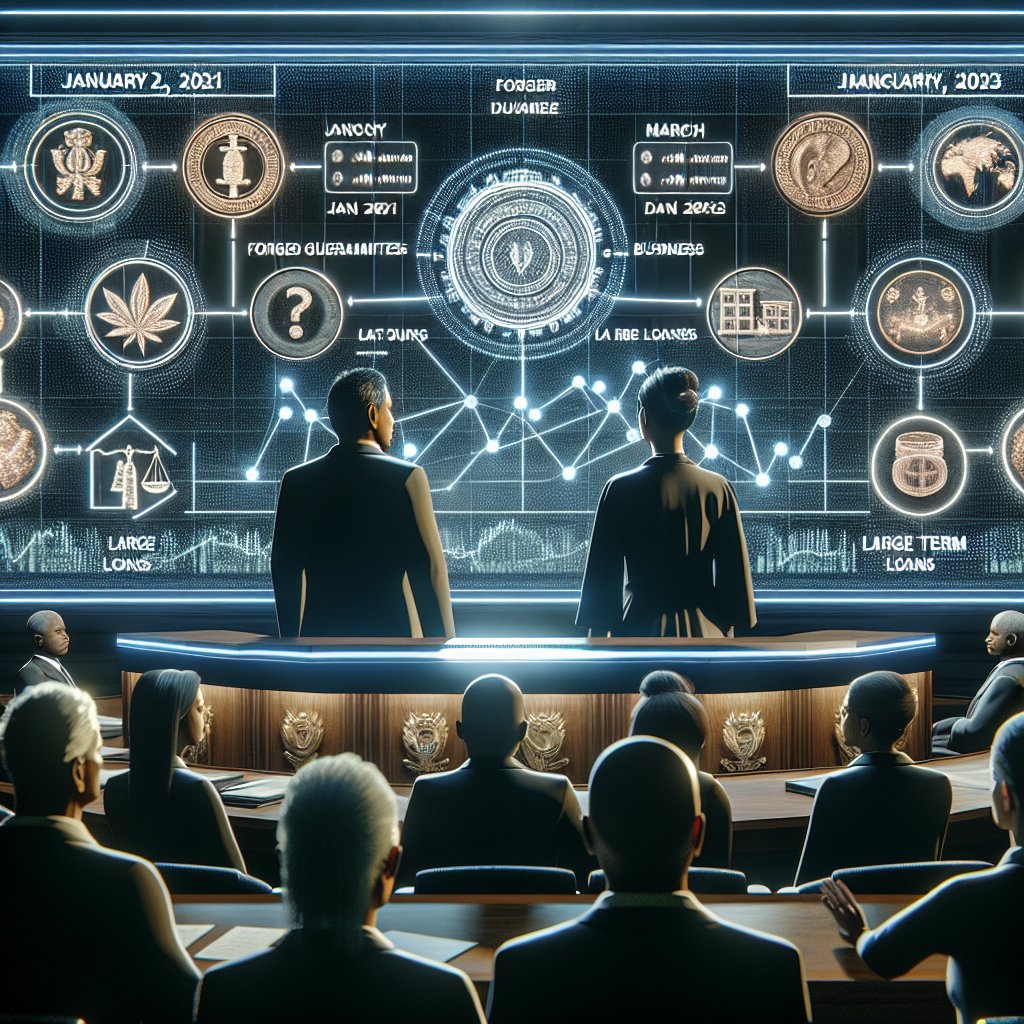

The case, investigated by the Hawks' Serious Commercial Crime Investigation team, spiraled from a complaint initially registered in March 2023 at the Sandton police station. According to the prosecution, between January 2021 and March 2023, the Singh siblings, acting as directors of Big Business Innovations Group (Pty) Ltd, engaged in fraudulent activities to secure substantial financial leverage from banks.

As part of their deceitful tactics, they submitted forged Stanbic Guarantees to obtain a working capital facility of R35 million. Their financial scheming did not end there; in April 2021, the pair ambitiously applied for a term loan agreement that exceeded R150 million. Unfortunately for Investec Bank, when the siblings depleted the capital facility and failed to adhere to the term loan agreement, the bank called upon the guarantees provided by Stanbic only to discover a fraudulent plot. The shock revelation was that these guarantees were not valid, leaving Stanbic to grapple with an actual loss exceeding R150 million.

The arrest of Rushil on Monday, 26 August 2024, followed by Nishani's surrender to the Hawks on Tuesday, 27 August 2024, signifies a noteworthy clampdown on white-collar crime. They now await the court's decision, with their bail application scheduled to resume on Wednesday, 28 August 2024.

The prosecution's case hinges upon the intricate specifics of the fraudulent activities carried out by the accused, which the Serious Commercial Crime Investigation team meticulously documented. The financial institutions involved are likely to pursue stringent measures to recover the lost funds and ensure such fraudulent acts are not replicated in the future.

The situation raises concerning questions about the checks and balances within the financial sector, and it highlights the sophisticated lengths to which fraudsters are willing to go. As the siblings face the legal consequences of their alleged actions, their case serves as a sober reminder of the importance of corporate governance and the need to reinforce ethical business practices.

The South African judicial system is keenly observing the proceedings of this high-profile case, which could potentially set precedents for how similar white-collar crimes are handled in the future. Investors, business owners, and the general public await the outcome with bated breath to see justice served and reassurance provided that the financial systems have integrity.