Image: AI generated for illustration purposes

South Africa Moves to Cement Anti-Corruption Measures and Strengthen Tax Governance

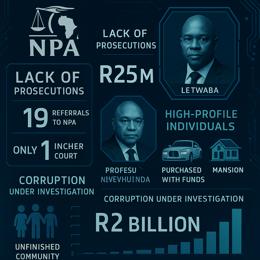

In a bold initiative to eradicate the remnants of state capture and ensure integrity within key state entities, South Africa is on the brink of implementing new legislation that addresses systemic corruption and poor governance that have plagued various institutions in the past. This announcement from the National Treasury comes as a direct response to the sobering revelations made by the Zondo Commission of Inquiry into Allegations of State Capture and the Nugent Commission of Inquiry into Tax Administration and Governance at the South African Revenue Service (Sars).

The National Treasury's commitment to introduce this legislation as early as January is a testament to the urgency with which the South African government is approaching the matter of state capture and its related governance failures. With the previous Director-General of National Treasury, Ismail Momoniat, emphasizing the importance of targeting the kind of corruption that incurs financial losses, it’s evident that the proposed laws are zeroing in on tangible offenses that have a detrimental impact on the country’s economy. Momoniat’s insistence on a merit-based appointment process free from political influence signifies a resolve to depoliticize the functionaries of pivotal institutions and ensure independent, qualified leadership.

A noteworthy aspect of the legislation is the restructuring of the tax system, intent on absorbing the lessons of the state capture era. Confronting the discretionary powers yielded by the Sars commissioner is integral to preventing misuse and abuse. As evident from Momoniat's remarks, regardless of the integrity of current leadership, the potential for just one misguided individual can cause considerable damage. Thus, having systems and laws in place that restrict absolute power is deemed essential.

The past decade’s establishment of the Office of the Tax Ombud (OTO) is reflective of the country’s initiatives to impose checks and balances against Sars' sweeping authority. As championed by former tax ombud Bernard Ngoepe, an autonomous OTO is crucial to safeguarding taxpayer rights. However, Momoniat’s comments on conceptualizing independence within state entities underscore the importance of defining the scope and limits of such independence to prevent the decay of institutional integrity, as illustrated by contrasting tenures at the Office of the Public Protector.

The recommendations made by Judge Robert Nugent, which include the proposal for an inspector general for Sars, reinforce the idea that there must be avenues for employees to air grievances and be heard—a reminder of the era marked by former commissioner Tom Moyane, which was riddled with suspicion and fear. Nugent’s comments at the OTO's birthday festivities highlight the need for an individual within the system built explicitly to address concerns and provide a trusted recourse for internal whistleblowers.

Corruption, as Momoniat asserts, remains rooted in South Africa, and the path ahead involves navigating through the remnants of its toxic past. With the palpable urgency conveyed in crisis management to stem the pervasive tide of corruption, the impending legislation marks a crucial step forward in restoring faith in public institutions and fortifying the country's democracy.