Image created by AI

IMF Boosts Egypt's Economy With $820 Million Funding Amid Fiscal Challenges

In a significant move to bolster Egypt's floundering financial situation, the International Monetary Fund (IMF) has released a substantial disbursement of $820 million to the Egyptian government. This funding comes as an integral part of an augmented assistance plan, initially put in place at the close of 2022 to aid the struggling economy of the North African country. As part of a larger $3-billion support package, this immediate fiscal injection signals international confidence in Egypt's reform commitments despite ongoing internal and external pressures.

The IMF's Executive Board, after lengthy deliberations, sanctioned this crucial payment, which promises to provide some relief in the face of mounting economic challenges. This move solidifies the IMF's total commitment to Egypt at an impressive $8 billion. It accompanies an earlier approval for a $5-billion extension, which indicates substantial ongoing support for Egypt's economic health.

The Egyptian government's efforts to meet the IMF's requirements have not gone unnoticed. All milestones placed by the IMF for the first two stages of the aid program have been met, barring the stipulation regarding foreign currency reserves. Kristalina Georgieva, the IMF's Managing Director, commended the Egyptian authorities for taking "significant" and "difficult" steps towards correcting macroeconomic imbalances. These steps include unification of the exchange rate and rigorous amendments to monetary and fiscal policies to foster a more sustainable economic environment.

In a decisive measure to tamp down inflation, Egypt's central bank hiked interest rates drastically to 27.75 percent, a measure that resulted in a sharp devaluation of the Egyptian pound. These developments came against a backdrop of cascading national currency value, which had plummeted by almost 50 percent over recent months.

Egypt grapples with extensive socioeconomic pressures, with nearly two-thirds of its population of 106 million living at or just above the poverty threshold. Concurrently, the nation confronts diminishing foreign currency revenue streams. Tourism, once a stalwart of the Egyptian economy, has been dramatically impacted first by the COVID-19 pandemic, followed by lingering repercussions from the Ukraine war and escalations in the Gaza Strip.

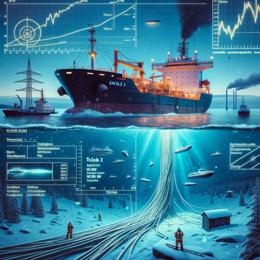

Further complicating the economic landscape are reduced earnings from the Suez Canal, a pivotal conduit for global trade. Aggression from Yemen's Huthi rebels in the Red Sea and Gulf of Aden has significantly cut dollar revenues from this critical waterway, with estimated drops of 40-50 percent since the year's commencement according to the IMF report.

Under President Abdel Fattah al-Sisi's rule, commencing in 2013, Egypt has pursued a gamut of infrastructure megaprojects. Economists argue that these ventures have failed to spawn fresh income, instead straining the nation's fiscal resources. Over the past nine years, the country's foreign debt soared from $46 billion to a colossal $165 billion, positioning Egypt precariously on the brink of possible debt default, second only to the turmoil-stricken Ukraine.

Looking to the future, the IMF has adopted a cautiously optimistic stance regarding Egypt's economy. The organization projects an uptick in economic growth to 4.4 percent for the upcoming fiscal year, a promising leap from the 3 percent growth estimated for the current fiscal period ending on June 30th.